In recent months, the PCP financial scandal has emerged, capturing the attention of millions who have purchased vehicles on finance before 2021. The issue, as highlighted by Martin Lewis, founder of MoneySavingExpert.com, revolves around potentially unfair charges that could have affected “millions” of vehicle owners. This article explores the rise of PCP claims, the widespread impact on consumers, and the regulatory response to address the situation.

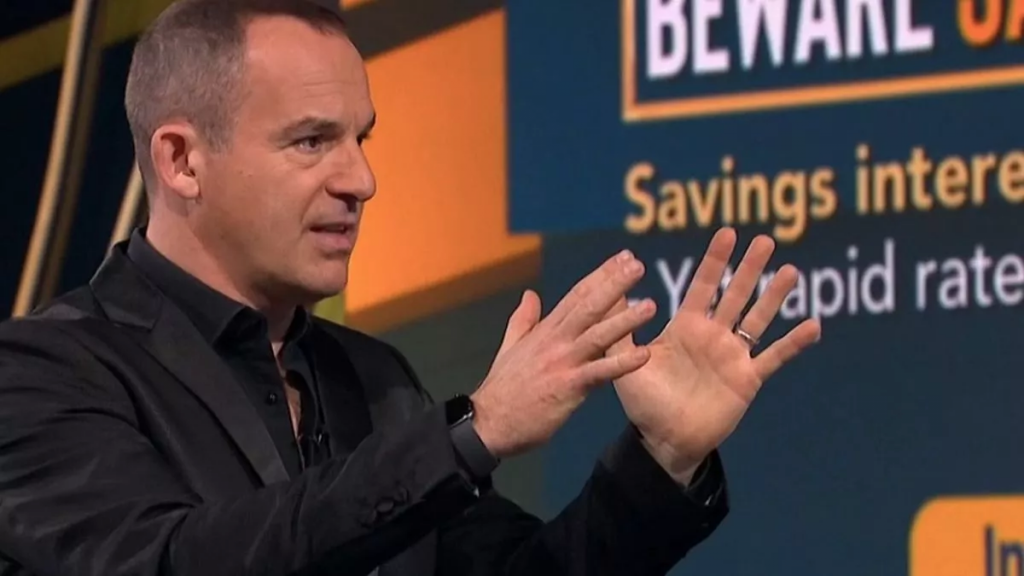

Martin Lewis brought attention to the issue in a recent episode of the Martin Lewis Money Show on ITV. He revealed that individuals who financed their vehicles may have faced inflated prices due to a practice that allowed dealers to set interest rates on loans. While this practice was banned in 2021, the Financial Ombudsman Service (FOS) reported hearing from “more than 10,000” people concerned about potential overcharging. The FOS’s recent rulings in favor of two consumers prompted the Financial Conduct Authority (FCA) to launch an investigation.

Martin Lewis cautiously compared the situation to the Payment Protection Insurance (PPI) scandal, indicating that the scale of refunds could be substantial. He estimated that the compensation paid back to affected individuals could surpass £10 million, potentially impacting the economy. The FCA’s decision to freeze complaint handling for car and van finance claims underscores the gravity of the situation and the need for a comprehensive review.

The FCA’s investigation focuses on discretionary commissions between lenders and car dealers. Martin Lewis emphasized that this affects individuals who bought vehicles before 28th January 2021, using Personal Contract Purchase (PCP) or higher purchase finance. He revealed that lenders were granting discretionary commissions to car dealers, increasing the cost of finance without disclosing it to consumers. The FCA’s involvement suggests a possible systemic mis-selling of car finance, leading to the consideration of a redress scheme.

How does the PCP scandal affect car owners?

If widespread misconduct is identified, the FCA aims to ensure affected individuals receive compensation in an orderly and efficient manner. Martin Lewis encouraged affected motorists to file complaints despite the freeze, emphasizing the importance of meeting any potential backdated cutoffs. He expressed hope that the process would be structured to discourage the use of claims handlers, ensuring a simpler and more transparent resolution for consumers.

The rise of PCP claims has unveiled a potentially significant financial scandal affecting millions of vehicle owners. As the FCA investigates historical motor finance commission arrangements, consumers await clarity on compensation and redress. The echoes of past financial scandals serve as a reminder of the importance of regulatory oversight and transparency in the financial industry, as affected individuals seek justice and fair compensation.

“As we uncover the magnitude of potential overcharging in car finance, it could surpass £10 million and have repercussions that may affect the economy. This under-the-radar issue demands attention, and affected individuals should not hesitate to file complaints to secure their rightful compensation.”

– Martin Lewis, MoneySavingExpert.com founder.

As affected car owners navigate the complexities of seeking compensation, legal assistance can be a crucial ally in ensuring a fair resolution. Courmacs Legal Ltd is ready to assist individuals in their pursuit of justice. Offering expertise in two distinct avenues, helping clients explore the irresponsible lending route, investigating whether dealers neglected necessary financial checks before offering financing. Alternatively, through litigation, Courmacs Legal can delve into cases where dealers may have surreptitiously increased interest rates to bolster their commissions, unbeknownst to the client. Navigating these legal channels with the support of Courmacs Legal provides car owners with a strategic and informed approach to reclaiming the compensation they deserve.

7 responses

UK PCP contact me regarding this same matter and is looking into my car finance situation. Do you know of them to be a reputable organisation?

Is your company utilizing a Facebook ad by Louisatips.co.uk ?

Yes 🙂

Why is my vehicle not recognised??

Hi! If you give us a quick call we can have a look into this for you! 0330 341 0481 🙂 thanks!

Hi, achoice insurance 3 party used clothes brothers to insure my car for the year over 2017/2018 I have paperwork.

Also wondering I took out PCP with “moneyway” shows they took over £1000 interest rate for the finance of the vehicle that achoice used to insure via clothes brothers.

If you fill in our form at https://courmacslegal.co.uk/services/mis-sold-pcp-car-finance-claims/claim-enquiry/ we can check if you have a claim 🙂